How Long Can Canadian Snowbirds Stay In The US?

How long can Canadian snowbirds stay in the US? That's a great question - and if you're a Canadian citizen who appreciates a bit of warm, sunny weather now and then, it's one that you should learn the answer to as soon as you can.

Whether it's Ontario, Newfoundland, Quebec, or some other province that you call home, understanding the ins and outs of American immigration guidelines is important if you travel there frequently.

If you're a snowbird, you might travel to the United States only seasonally, visiting the south just when it starts to get chilly. Rather than facing annoyances and risks such as icy falls, pneumonia, and the plain unpleasantness of harsh winters, many Canadians who are retired or have the luxury of working remotely flock to the US instead.

Though you might consider yourself a temporary traveler and not someone seeking to make the US his permanent home, depending on how long you are staying, the American government might have a different opinion.

Here's what you need to know about the entry requirements for a Canadian resident to the United States - as well as what period of time is considered acceptable for a "temporary visitor."

| Thinking about traveling to the US? Consider travel medical insurance from Best Quote Travel Insurance. |

How Long Can a Canadian Stay in the United States?

Canadian visitors can generally stay in the United States for a maximum of six months (or the equivalent of 182 days) during a single 12-month period. This period of time spent there could be a single trip or a combination of multiple trips.

If you plan on visiting the United States for any period of time longer than that, you will need to take steps to secure a visa.

There are certain exemptions to these guidelines, however.

For example, if you plan on visiting the United States for any reason other than pleasure, such as business or education, you will need to obtain a visa regardless of your length of stay.

Not only that, but if you have any kind of criminal record, this can prevent you from obtaining US immigration status or even entering the United States for a short period of time as a tourist.

Staying in the United States Without a Visa

If you don't have a visa, that's not necessarily a problem.

First, know that you can travel to the United States under the Visa Waiver Program for up to 90 days. This is regardless of the reason for your visit as well as which country you are visiting from (Canadian citizens visiting for just a month or two automatically fall within these eligibility criteria).

This is the easiest way to stay in the United States if you don't have a visa and are from a country besides Canada. It doesn't require you to apply for a traditional visitor visa (a B1 or B2). Of course, if you need to stay for an extended period beyond 90 days, that's not an option.

Under the Visa Waiver Program, you must meet the following eligibility criteria:

- You have a passport from your home country that is valid for at least six months from your planned date of departure from the US.

- You do not plan to permanently reside in the US.

- You have not been present in or a national of Libya, Iraq, Iran, Sudan, Syria, Somalia, Yemen, or any other country designated by the DHS as supporting terrorism or being "of concern.”

- Be from a list of approved countries in the Visa Waiver Program (Canada is not one of them - we include this checklist merely for clarification purposes)

- You have valid authorization under ESTA and haven't violated terms of non-immigrant visas in the past.

- You plan to visit for no more than 90 days

- You are not entering on a private aircraft or unapproved carrier

To enter the country under these standards, you will need to arrive in the US in your own vehicle OR have a return ticket to your home country when you arrive. Often, when you cross the border, you will need to complete a brief interview with a CBP officer to make sure you are eligible for admission.

Now, Canadians fall under separate exemptions due to their proximity to the United States. Again, you can stay in the United States for up to six months without requiring a visa in almost all situations, including if you are a snowbird.

Extending your Stay in the US Without a Visa

If you want to extend your stay in the United States past six months, you can do so, but it will require a bit of legwork.

You will need to apply for an Application to Extend/Change Nonimmigrant Status. This can be done by completing Form I-539 before your authorized stay expires. This is done through the USCIS.

Again, you must complete this application BEFORE your stay expires - don't wait until the last minute, as the paperwork does take some time to process.

Staying in the United States With a Visa

Canadians don't require visas for the United States if they're traveling for leisure - we're looking at you, Labrador snowbirds! The good news is that if you're just passing through the United States (say, if you're driving from Alberta to Mexico or headed to a port to board a cruise ship) you don't need a visa, either.

There are some cases in which even business travelers don't need to apply for visas - but it's a good idea to double-check to make sure.

You do not need a visa unless you plan to work, invest, study, or immigrate. You just need a valid passport.

If you plan to eventually immigrate to the US, it's a good idea to get a visa. You might think you can enter the US under the temporary six-month visit exemption and immigrate later. However, if you plan to work, live, and/or study inside the US eventually and don't disclose this information when you enter the country, you could be barred from the United States for good.

So if you're visiting Canada, even as a snowbird, but think you might want to immigrate later, go ahead and apply for the visa.

There are many types of visas you can apply for, including work visas, student visas, business visas, and more. You can get more information on staying in the US with a visa here.

How Long Can Canadian Visitors Stay in the US Without Paying Taxes?

The guidelines above apply only to residency in the United States - and aren't necessarily meant to be used for tax purposes.

However, the timeline is similar. If you plan to stay in the United States for less than six months, you don't have to worry about paying any taxes. If you stay longer than that, you'll have to file tax forms with the IRS.

Here's how to figure out whether you're liable to pay taxes as a Canadian citizen to the United States.

The Substantial Presence Test

The Substantial Presence Test is something that the Internal Revenue Service uses to determine citizenship for tax purposes. To meet the requirements of this test, you must be "physically present" in the country on a minimum of:

- 31 days during the current year

and

- 183 days during the three-year period that includes the current year as well as the two years immediately before that. This includes:

- the days you were present in the current year and

- 1/3 of the days you were present in the year before that

- 1/6 of the days you were present in two years prior

For you to be considered "physically present," you must be in the United States at any time during the day. You should not count the following examples as being physically present:

- days you were commuting to work in the United States from a residence in Canada

- days you were in the United States for less than 24 hours (or in transit between two separate places outside the US)

- days you were in the US as a crew member on a foreign vessel

- days you could not leave the US because of a medical condition that developed while you were there

- days in which you were considered an exempt individual (exempt individuals are those who were holding foreign government-related individuals with "A" or "G" visas, teachers or trainees under "J" or "Q" visas, students in the US under "F," "J," "M," or "Q" visas, or professional athletes temporarily living in the US)

You can find more information about the substantial presence test here.

Closer Connection Exception

The substantial presence test can be quite complicated and convoluted to unravel, but once you get the basics, you'll have a good understanding of how long you might be able to stay in the United States (for tax purposes, at least).

Canadian snowbirds might also benefit from taking a look at the Closer Connection Exception. This exemption applies if:

- you are a student

- you are a nonresident alien who was present in the United States for fewer than 183 days and had a closer connection to a foreign country in which you had a tax home than to the United States

For this exemption to apply, you can't have taken steps for lawful permanent residence in the United States (in other words, applied for a green card).

Usually, you can prove that you have a "closer connection" to Canada by doing things such as having a permanent home, a family, a business, a driver's license, and a voter's registration in Canada.

US Tax Treaty Exemption

The US Tax Treaty Exemption is another one to keep in mind. If you stay in the United States past 182 days (roughly six months), you may be able to receive an exemption under this policy.

This depends on the following factors:

- Whether you have a permanent home in Canada or the United States

- Which country to which you have stronger economic and personal ties

- In which country is your "habitual abode"

- What your current citizenship status is

The vast majority of Canadians living in the United States don't pay any taxes. There's also the Foreign Earned Income Exclusion - if you can demonstrate that you maintained a residence in Canada at least 330 days a year, you can exclude the first $100,000 from US income tax.

What Happens if a Canadian Overstays in the US?

If you're still not ready to go back to the northern chill, you might think, "what the heck. I'll just stay a little longer. Who's going to find out?"

Don't risk it, especially if your visit will extend past six months.

It is not legal for a Canadian to stay in the United States longer than six months within a 12-month period if he does not have the proper visa and documentation. Although you might be able to stay longer by providing closer connections, it's not a good idea to push your limits.

A CBP officer can refuse a visitor entry if he believes that you are no longer a temporary visitor - this can sometimes wind up being very subjective. He might assume you have abandoned Canada and are living permanently in the United States and it can be a tricky situation to get yourself out of.

If you're caught overstaying in the United States, you might be barred from returning to the US for at least three years. If you overstay for longer than one year, you could face a ten-year ban. That's a serious bummer!

If you aren't sure whether you qualify to stay longer than six months, it's a good idea to visit the United States CBP website to get more information.

And if you accidentally overstayed your visit, get in touch with an immigration lawyer. They'll let you know what your next steps should be so you can stay out of any self-imposed hot water.

How Long Can a Canadian Snowbird Keep Their Provincial Health Insurance?

One other concern for Canadian snowbirds traveling to the United States has to do with health insurance.

After all, healthcare coverage is a major benefit to living in Canada - and it's likely something you don't want to lose if you're just temporarily visiting the United States during the winter months.

Staying outside your province for too long can jeopardize your provincial health care coverage.

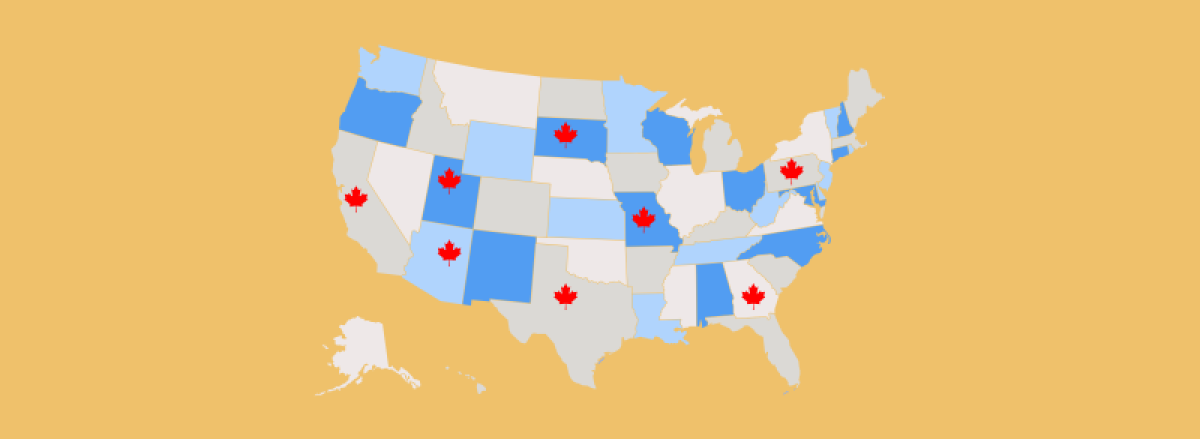

In British Columbia, Manitoba, Saskatchewan, Alberta, Ontario, Nova Scotia, and New Brunswick, you must be in residence for at least five months to continue your health insurance coverage. Prince Edward Island and Quebec require six months but in Quebec, trips of fewer than 21 days don't count. Labrador and Newfoundland require just four months, while Yukon and Nunavut have zero residency requirements

The good news is that this timeline matches up pretty cleanly with the same residency requirements for visiting the United States as a Canadian. Just don't cut the calendar days too close when you're planning your visit, and you should be just fine - both in terms of health insurance and immigration laws.

What Are the Rules for Snowbirds Buying Supplemental Travel Health Insurance?

There are lots of benefits to visiting the US as a snowbird, but you must make plans in case you need to visit a doctor or receive emergency medical treatment while you're out of the country.

Canadian health insurance is not valid outside of the country so it's recommended that you buy travel insurance.

The rules for buying supplemental travel health insurance vary depending on the provider since most are offered by private insurers. It's a good idea to read the fine print carefully since there are some limitations and exclusions surrounding various coverages. Some pre-existing conditions might not be covered, either, so be diligent in your search.

Conclusion

There has been some discussion in the United States about extending the time that Canadians can stay in the US to 240 days for individuals who are older than 50 years old (as well as their spouses).

However, this proposal has not yet passed - so don't hold your breath. Instead, make sure you have your plans squared away accordingly to make sure you can enjoy the warmer weather in the United States without having to worry about taxes, your residency status, your health insurance - or the immigration service!

After all, your time spent as a snowbird should be spent lounging in the sun and sipping fruity drinks - not fretting over which IRS form you need to fill out. Plan wisely for your time away from home!