IEC (Working Holiday) Health Insurance for 2025

International Experience Canada (IEC) Visa: 2025 Insurance Guide

Travellers visiting Canada for up to two years on an International Experience Canada visa (a.k.a. 'working holiday visa') need to check off the following boxes these days to earn their Canadian work experience:

- apply and receive the Port of Entry (POE) letter;

- find an affordable plane ticket; AND

- find the required private travel health insurance which meets the government of Canada's basic IEC visa insurance requirements; THEN:

- Find a job here in Canada (hopefully a good one!)

BestQuote helps your budget with the IEC insurance requirement (just complete the quote form to instantly see the best options), and check our careers page for the last item above if you are coming to Vancouver, as we are adding to our BestQuote team here too!

Why do I need IEC insurance?

According to the government of Canada's CIC website concerning IEC requirements, the required insurance must cover health and hospitalization expenses, as well as repatriation costs in the event of a death or emergency return to one's home country.

The insurance must be held in place for the entire duration that someone remains in Canada under their IEC visa, regardless of whether they become covered by a provincial government health insurance plan (GHIP). Specifically, the CIC states that:

"The Border Services Officer may ask you for proof of health insurance. You may be refused entry if you do not have insurance. The insurance must cover:

- medical care;

- hospitalization

- That is, it must cover the cost of you staying in a hospital for medical care (if required);

- repatriation

- That is, it must cover the cost of getting you:

- to a medical facility

- back to your home country or

- returning your remains to your home country.

- That is, it must cover the cost of getting you:

When you arrive at the port of entry, you must have health insurance valid for your entire stay in Canada. Having a valid provincial health card is not enough. Repatriation is not covered by provincial health insurance.

If your insurance policy is valid for less than your expected stay, you will be issued a work permit that expires at the same time as your insurance. If this happens, you will not be able to apply to change the conditions of your work permit later."

Upon arrival in Canada, IEC program participants will be asked to present their passport and visa, proof of funds for living expenses, and proof of comprehensive insurance coverage before receiving their work permit. The IEC work visa will only be issued for the length of time that the traveller can show insurance coverage. So don't expect to receive a 24-month IEC visa with only one year of insurance coverage.

Private IEC Health Insurance:

Private (travel) health insurance plans for visitors to Canada — such as those required by IEC travellers — cover emergency medical expenses for accidental injuries or emergency illnesses. There are always certain restrictions and limitations when it comes to private insurance plans. For example, there are no expenses to be paid for someone who injures themselves while intoxicated or knows that they would need to seek medical attention before purchasing, etc. In contrast, provincial health insurance (which IEC visa holders are entitled to apply for once they arrive in Canada) is much less limited.

While the CIC points out above, "Repatriation is not covered by provincial health insurance." They should also point out that provincial GHIP will not cover things like:

- Ambulance rides;

- Prescription drug costs related to recovering from accidental injury or emergency illness;

- Medical device or equipment rentals such as crutches, wheelchairs, casts, etc.;

- Differences in medical costs between provinces (when injured or sick outside home province);

- Costs to have a family member visit you if hospitalized at length;

- Incidental hospital costs (internet, television, parking, etc.);

- Medical expenses incurred while travelling outside Canada

Because there is no requirement to enroll in GHIP (IEC visa holders need to meet certain employment conditions to enroll), and because it often takes up to three months before GHIP coverage begins after enrolling, - the IEC program requires private insurance during your entire stay in Canada.

But private travel/health insurance is not perfect either. While private insurance will cover (subject to policy restrictions, exclusions and limitations) repatriation costs and the items mentioned above, it won't cover some important items that provincial health insurance WILL cover such as:

- Non-emergency medical visits (i.e. regular doctor visits);

- Pregnancy-related medical expenses;

- Medical expenses related to drug or alcohol use;

- Accidental injury from extreme sports or willingly exposing yourself to injury (through sports or otherwise);

- Medical expenses related to unstable pre-existing medical conditions;

- Mental illness related medical costs.

So, while buying private insurance that covers health and repatriation expenses and maintaining that insurance for your entire stay in Canada is a requirement of the IEC work permit program, the smartest way to ensure that you will be covered in the event of some medical bad luck is to apply for provincial health insurance as soon as you have proof of employment when in Canada - to combine GHIP public coverage with your private insurance! And guess what? Provincial health insurance is FREE!

Get a free instant price comparison to research Canadian IEC insurance options:

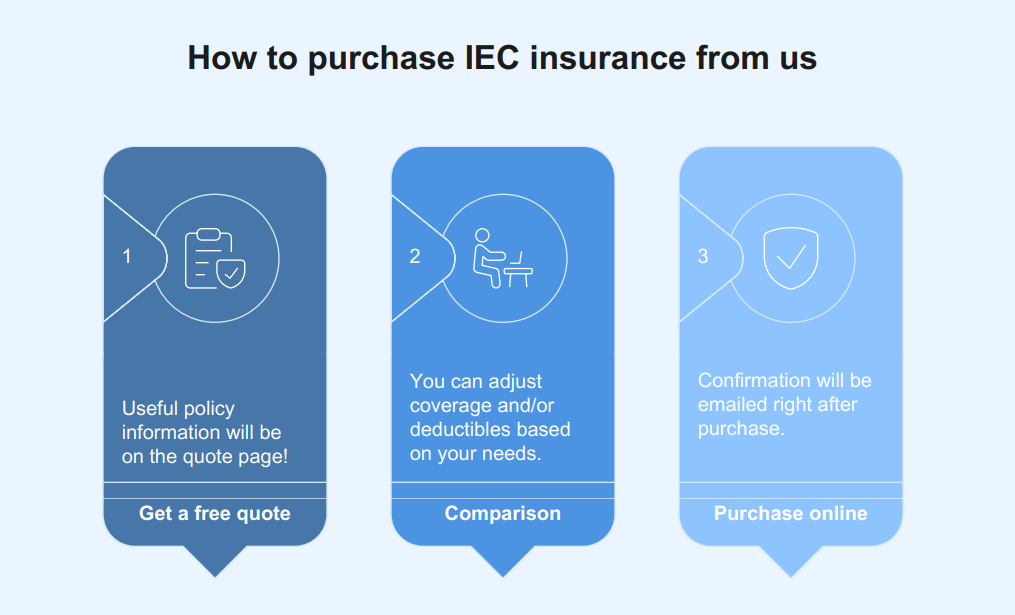

The quote engine on the side of this page allows travellers to get a free instant quote and view a list of available policies under the 'IEC Visa Insurance' category and then purchase a policy online. Useful policy information (prices, benefits, important secondary benefits, refund policies, etc.) that you can review and compare is provided on the quote presentation page. If you came to this website to research your insurance options, you can't do that without getting a quote!

We'll also email you a link to your quote for future reference. If you have any problems receiving a quote or have some specific questions you need to ask, don't hesitate to call us (1-888-888-0510). After purchasing online, confirmation of coverage and policy document(s) will be emailed to you as soon as your purchase is processed. We suggest that you keep a copy for your records, print out a copy and carry it with your other travel documents to show as proof of insurance at the border when you enter Canada.

So, what does IEC health insurance cost?

BestQuote has a policy issued through Lloyd's Underwriters (A+ 'Very Strong' financial rating from Standard & Poor's), which has been designed specifically for the IEC traveller. It provides the required emergency health and repatriation benefits, allows for trips home without voiding coverage, will allow for 'early return refunds' (if plans change and you return home early and there have been no claims on file, then the pro-rata amount of unused insurance premium is refunded), as well as a 25% return of (remaining) premium if/when a policyholder becomes covered by provincial medical. In addition, it allows for side trips outside Canada (unlimited trips up to 35 days each). But the best part is that our 'BestQuote MedEC Visitors Health and Repatriation' plan now comes with access to Maple telehealth! Through Maple, policyholders have access to 3 pre-paid doctor consultations per year (which may be used for emergency consultations or for non-emergency needs such as renewing an existing prescription free of cost (no other travel insurance policies from any other countries provide such non-emergency benefits)!

The BestQuote MedEC Visitors Health and Repatriation Insurance policy is shown at the top of your quote (get an instant quote by filling in quote request form — most of the policy information is on the quote presentation page). The cost has been reduced significantly because of BestQuote's cover holder status with Lloyd's (we are approved to issue the insurance coverage directly ourselves, 'cutting out the middleman') and because of the lower-risk group involved (younger and relatively healthy travellers) compared to other available insurance policies (that also insure older travellers).

This has allowed us to lower the cost for travellers less than age 36 to $1,189.90 (CAD) for 2 years of coverage for $100,000 sum insured with $0 deductible (a.k.a. 'excess'). For an additional cost you can add coverage for recreational winter sports such as skiing and/or snowboarding, which is otherwise excluded.

Or, for example, with $50,000 sum insured and a $250 deductible, two years of coverage costs just $945.35 for 730 days — $472.68 for one year.

There are various coverage amounts available, and various deductible (a.k.a. 'excess') amounts to choose from which can increase or decrease the required premium from the above-mentioned amounts. There is a further 5% discount for travellers purchasing more than one policy at a time.

For more information about the IEC insurance, visit our IEC Insurance Blog.

For more information about the IEC insurance, visit our IEC Insurance Blog.

What is a GHIP partial refund?

The BestQuote MedEC Visitors policy is the only policy in the world that will provide a partial refund of premium when a policyholder enrolls on provincial GHIP (25% of the remaining premium is refunded once enrolled in provincial GHIP, less a $25 admin fee), which can help lower your IEC insurance costs by several hundred dollars. For example, a person purchasing the MedEC policy with $100,000 coverage and a $0 deductible for 2 years will pay $1,825.00. If the person arrives in Ontario and secures a job that provides them a letter of employment to apply to OHIP (some employers help you to apply) and becomes covered by OHIP benefits after 74 days (for example), they will have $1,640.00 of unused premium remaining on their MedEC policy - so the GHIP refund will provide a premium return of (25% of $1,640.00 = $410.00, less $25.00 for processing =) $385.00.

Receive free online medical consultations as part of your MedEC coverage!

We have added Maple (a Canadian virtual healthcare provider) to our BestQuote MedEC policy (shown at the top of your quote). This is HUGE. Now, truly, our key offering for IEC travellers just got significantly better.

The BestQuote MedEC Visitors Health and Repatriation Insurance policy now provides access to Canadian primary care physicians quickly and easily through Maple's virtual healthcare app (3 free pre-paid doctor's appointments per year). No other IEC insurance policy provides this immediate access to (emergency or non-emergency!) primary care! The Maple platform alone usually costs Canadians $80/month (individual or family, unlimited use). Check your quote again, and look for the 'Maple' pdf below the BestQuote MedEC logo for more info.

The BestQuote MedEC Visitors policy is underwritten through and financially backed up by Lloyd's — the world's specialist insurance and reinsurance market for over 300 years. It took us a lot of work to secure this policy for our customers and to arrange high-quality coverage at an affordable price.

BestQuote also offers various policies from Canadian (and/or American) insurance companies that cover stable pre-existing medical conditions (such as diabetes or chronic heart conditions, etc.), or more hazardous extreme sports (from rock climbing, backcountry skiing, bungee-jumping or rodeo!), although many of these are usually only available for one year at a time. Please note that Canadian travel insurance companies do not offer travel insurance policies that offer personal liability coverage, although some USA companies will.

There may be many IEC travel insurance policies to look through depending on whether you are arriving from Europe or the United Kingdom (although most UK policies are completely non-refundable after their 'free look' period (14 days) - so if you change your plans about staying in Canada you can't get money back!), Australia or New Zealand (where current premiums are prohibitive), or other Asian countries like Japan, Taiwan or South Korea (usually also much higher cost).

International travel insurance companies will often package together their medical emergency coverage with other coverage for things such as personal effects and/or luggage or expenses related to trip cancellation/interruption - although once the contract details are looked at carefully, you may find that the coverage doesn't quite justify a higher cost. For example, trip cancellation/interruption costs related to COVID may not be covered, or baggage items won't be replaced without a police report and/or original receipts.

We believe that we have designed the BestQuote Visitors policy to meet the real needs of most IEC travellers - high-quality private medical emergency coverage (that combines well with the available (free) Canadian provincial health plans) that is cost-effective, and refundable if plans change and you return home early.

Fill in the price comparison request form on the left to see our available options!

Up To 2-Year Working Holiday In Canada!

While most working holiday insurance policies are only available for up to 12 or 18 months, BestQuote's database has several IEC policies that are available for up to two years at a time, which means that if you are from Ireland, the UK, France, Australia, Portugal, Korea or New Zealand (max 23 months) — you can receive a two-year visa — eliminating the uncertainty of needing to re-apply for any visa extension! For the most accurate and up-to-date information, please refer to the official IRCC website.

| UK | Up to 3 years |

| France | Up to 2 years |

| Australia | Up to 2 years |

| Ireland | Up to 2 years |

| Portugal | Up to 2 years |

| South Korea | Up to 4 years |

| New Zealand | Up to 23 months |

As a Canadian provider of travel health insurance (providing free price comparisons of the Canadian travel insurance marketplace), BestQuote can offer coverage to any nationalities coming to Canada, whether they have already left home or not. Every year, we help hundreds of International Experience Canada program participants obtain solid insurance coverage at affordable rates to receive their IEC work permits upon entry to Canada.