Best Doctors Insurance Canada

Best Doctors Insurance - The Best Health Care for Canadians in 2024

Best Doctors international health insurance program is for career-oriented individuals, business owners, competitive sports enthusiasts and/or Canadians living farther from urban hospitals to ensure that they and their family members can receive top-level, world-class health care services whenever needed (in or outside Canada):

- to ensure proper diagnosis and treatment of a critical or chronic illness or any other medical uncertainty;

- to avoid lengthy Canadian wait times for diagnostic tests or surgeries; or,

- to access leading-edge medical procedures/technologies that are not found locally in Canada. (As COVID-19 causes many people to recover yet deal with ongoing health complications, known as 'long covid', medical solutions will be discovered around the globe to deal with such complications. Having access to global medical services will increase in importance for Canadians).

Getting high-quality diagnosis and treatment promptly (paid for anywhere in the world) can speed up recovery time, saving thousands in lost income or business/career disruption costs - not to mention that it can be the difference between life and death in more complex situations. There is also a significant impact in maintaining an active lifestyle when recovering from a critical illness.

Canadians get misdiagnosed frequently, even when they live in urban centres close to large regional hospitals. The reality is that the health services we each receive vary from province to province. Most hospitals in Canada do not have the same testing and medical procedure equipment as the regional urban hospitals. Most Canadians do not get diagnosed by the top five percent of medical practitioners in their field. The CBC has stated that "Experts estimate 10 to 15 percent of patients are misdiagnosed, though the true number is likely higher, as the problem is difficult to quantify". When Best Doctors Interconsultation Services were used for a second opinion by Canadian policyholders, the results were: changes to the original medical diagnosis in 27% of cases reviewed and changes the treatment program 60% of the time! Misdiagnosis and inefficient treatment programs can be life-threatening and/or negatively impact lifestyle and chances for recovery. This is a serious risk in Canada! Best Doctors Canada helps avoid that risk.

Whether you need to get back on track quickly for your professional career, because you are self-employed or due to an active lifestyle, Best Doctors Insurance can help give you quick access to testing and surgery (and pay the private medical costs), increasing your chances of a full recovery and saving you from suffering lost income and/or career disruption. Consider, for example, the following:

- Radiation – In Ontario, only 55% of breast cancer patients are seen by a specialist within 14 weeks.

- Prostate cancer surgery – In Ontario, the average is 120 days wait time for surgery.

- Heart Valve or Heart and related structure surgery – In Alberta, 4-6 month wait time (90%) for both types.

- The Canadian benchmark for hip or knee replacement is 38 weeks.

- The wait times for some forms of cancer treatment can be 6-12 months in Canada. During this time, physical and emotional health declines - and the result can be a long break in one's career. To expedite the waiting period, some people source and pay for their treatment at a private medical facility, often outside of Canada.

Some Canadians believe the myth that we have universal health care and that we have access to the world's best medical procedures. But the reality is that we are all subjected to regionalism (where we live) and randomness (which doctor we get), and all Canadians do not get the same level of health services. We get misdiagnosed and subjected to lengthy wait times (which vary greatly by province), second opinions are hard to come by (you cannot simply request them within the public system), navigating our health care options is not easy without professional help, and some medical procedures are only found on the opposite side of the country (with lengthy wait times), or outside Canada.

Best Doctors assumes the costs to get diagnosed by leading medical experts, to avoid medical uncertainty and to pursue top-quality medical treatment right away, in or outside of Canada.

What is Best Doctors?

In Canada since 1998, Best Doctors was founded in 1989 by Harvard Medical School physicians to ensure that patients (and their doctors) could access diagnostic support and treatment recommendations from worldwide medical specialists judged by their peers to be in the top five percent of their specific areas of practice. Offering a method of quality control on diagnosis and treatment is so important when it is needed the most that Best Doctors became a common feature of critical illness insurance products in Canada, with providers such as Sun Life, RBC Insurance, Canada Life, Empire Life, etc. offering access to Best Doctors Interconsultation Service as a standard feature of their critical illness insurance plans.

In Canada since 1998, Best Doctors was founded in 1989 by Harvard Medical School physicians to ensure that patients (and their doctors) could access diagnostic support and treatment recommendations from worldwide medical specialists judged by their peers to be in the top five percent of their specific areas of practice. Offering a method of quality control on diagnosis and treatment is so important when it is needed the most that Best Doctors became a common feature of critical illness insurance products in Canada, with providers such as Sun Life, RBC Insurance, Canada Life, Empire Life, etc. offering access to Best Doctors Interconsultation Service as a standard feature of their critical illness insurance plans.

This division of Best Doctors was sold to Teladoc in 2017, and now Best Doctors Canada offers their Global Medical Care insurance to Canadians as stand-alone coverage ($5 million for individual plans or $1, 2, or $5 million maximum benefit for corporate plans of five employees or more).

Global Medical Care (GMC) is an international private health insurance plan. It can be used to pay medical expenses in Canada, or outside Canada. If you purchase the product as an individual, couple or family (get a quote here to buy online); your application(s) will be medically underwritten (which may take a couple of weeks depending on your health and availability of your medical information). If you already have a significant health issue, it may be excluded from coverage or your application may be refused - so it is better to enrol earlier rather than to wait until you are already facing more serious health issues.

For corporate applications, premiums are determined based on the number of participants involved. For those that are interested please contact us directly at 1-888-888-0510, and a group rate will be determined. If the top 20% of company employees are covered by the plan there is no medical underwriting and coverage will extend to any pre-existing medical conditions after 24 months. Best Doctors GMC will pay for medical costs associated with emergency care, or for accessing testing or treatment anywhere in the world - so it substitutes for travel insurance when outside Canada but continues to cover a person against medical uncertainty and wait times while they are in Canada.

Optional Benefit: Annual Executive Medical Assessment combines the GMC coverage with the ability to get an annual proactive executive health assessment so that you and your family can stay ahead of medical uncertainty and medical emergencies as best you can. This valuable addition to GMC does not cost that much more relative to the basic GMC annual premium, considering that private clinic medical assessments are valued at about $2400 - $3000 across Canada. Policyholders that proactively stay on top of their health risk by conducting proactive assessments represent less risk to Best Doctors. That means that Best Doctors can lower the premium cost when the proactive assessments are added to the policy (underwritten through Lloyd’s Underwriters). Get a quote to see for yourself - it makes sense to choose this 'add-on' and get the best health insurance plan along with the best level of proactive testing to be found in Canada. More than 70% of personal plans are purchased with this Optional Benefit because people do see the value of the Executive Medical Assessments.

The following information has been provided by Best Doctors Canada regarding its insurance programs, cases, and the need to own your own access to top medical care:

How is an Executive Medical Assessment different from a physical with a family physician?

Best Doctors Insurance® takes a proactive approach to health care whereas the Canadian health care system tends to be reactive. For most Canadian patients, they see their doctor for approximately 10 minutes during an annual physical examination. They may wait several days (or longer) for test results. In most cases, a patient only hears from their doctor’s office if there is an issue with their test results. Many Best Doctors Insurance® plan members will tell you that an executive medical assessment changed their life. Why? With an in-depth screening to detect diseases like cancer and diabetes with a doctor actively focused on their specific risk factors, it changed their quality of life.

What happens during an Executive Medical Assessment?

The Annual Executive Medical Assessment provides a detailed picture of a patient’s current health. Patients start the 5-hour appointment by seeing the doctor, undergoing up to 15 diagnostic tests, receiving their results on the same day and having a private consultation with a physician for approximately 45 minutes. The physician discusses the test results, strategies to improve health through lifestyle changes and (in some cases) areas that require ongoing medical attention.

What’s included in an Executive Medical Assessment?

- The appointment is scheduled the same week of the request.

- Nutritious meals are provided during the 5-hour appointment.

- Up to 15 diagnostic tests (specific to gender/age/current health) are conducted.

- Same-day results are discussed during a private 45-minute consultation with the doctor.

- A customized health plan, including lifestyle changes or treatment, is created with the doctor.

Your Health Is Your Wealth!

Being proactive and safeguarding your health outcomes is an investment in your career, your family, and your lifestyle.

For successful professionals and entrepreneurs in Canada, the need for Best Doctors international private medical insurance has grown significantly over these last few years. A major illness or health condition could negatively impact your well-being and/or professional practice. Having access to the most proactive medical care system and funding to help overcome potential health risks in a timely fashion is essential.

Best Doctors Insurance provides its clients with the following advantages:

- immediate access to the best medical care (leading hospitals, cutting edge treatments and drugs, and top physicians) around the world including world-renowned centres of excellence outside of Canada such as Dana-Farber Cancer Institute, Cedars-Sinai, Stanford Hospital and MD Anderson Cancer Centre (no referral required);

- immediate access to MRI and CT scans in less than a week (at selected independent private imaging clinics located in Canada and abroad);

- an annual deductible of between $250 to $20,000. After the deductible, all medical expenses are paid at 100% (up to a $5,000,000 maximum benefit);

- guidance with seeking/obtaining a second opinion from a specialist (private Canadian clinics included) from a global database of over 53,000 medical specialists who have been recognized by their peers as leaders in their fields;

- personalized support by Best Doctors Registered Nurses, ensuring you receive 24/7 support to navigate through the global health care system and have the medical information and guidance you need to move forward with confidence;

- concierge assistance with booking hotels, flights, medical appointments and translation services when pursuing care away from home;

- an Executive Medical Assessment for a 360 degree checkup of your health (by purchasing Optional Benefit).

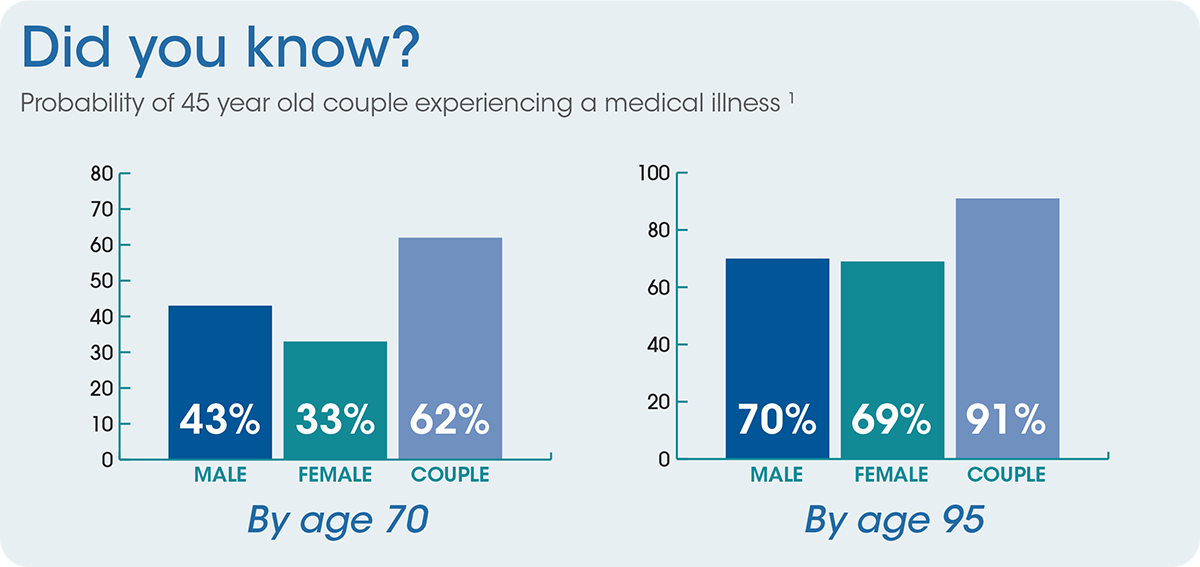

1 Based on data from the Canadian Pensioners’ Mortality Table (published by The Canadian Institute of Actuaries, 2014) and the 2008 Canadian Critical Illness Tables (published by The Canadian Institute of Actuaries, July 2012.)

So How Does Best Doctors Coverage Work?

Best Doctors claim process is straight forward, aimed at fulfilling claims as quickly and seamlessly as possible. There is a simple 1-2-3 step process:

- Send in a simple medical notification form.

- Receive a response within 2 business days.

- Next steps are put into action (i.e. appointment booking, second opinion).

Consider the following case information:

Benign Brain Tumour

This case involves the spouse of an oil & gas executive from Calgary who was diagnosed with a brain tumour. Her Interconsultation report stated that because of where the tumour was situated on the brain, she would be an ideal candidate for a procedure called gamma knife surgery. At that time, the only doctor in Canada that had the expertise to perform this procedure had a one-year waitlist. Traditional brain surgery would have been open skull surgery, and she would have been in ICU for five days in a medically induced coma. She chose to go to UCLA and have the gamma knife surgery done by a world-renowned neurologist who had been doing this procedure for over 15 years. The gamma knife surgery was non-invasive, and she was home in 15 days, the only requirement being a CT-scan at day 30 and an MRI at day 90. Her Canadian doctor arranged for diagnostics once she was home. The cost of this claim was US$310,000.

Knee Surgery

This case involves a client who blew his knee out playing squash. He saw his doctor and was booked for an MRI 5 weeks after his appointment. He called Best Doctors Insurance and had his MRI done at a private clinic in Canada within 2 days. The following week he was booked for arthroscopic knee surgery at the Cambie Surgery Centre in Vancouver, BC. He had his MRI & surgery completed within 2 weeks of notifying Best Doctors. The average wait time for this type of surgery in the Canadian healthcare system would have been 35 weeks. The cost of this claim was CAD$18,000.

Organ Transplant

This case involves a client from Ontario. In 2019, he found himself in need of a liver transplant. As a resident of Canada, under the public healthcare system, he would have had to wait nine months for such a surgery. Because his daily symptoms and conditions continued to get worse, waiting this long would have been extremely difficult and almost unbearable. Thankful for his supplemental Best Doctors Insurance policy, the client contacted Best Doctors in August 2019. Within a few days, Best Doctors arranged two appointments: one at a medical clinic in New York and another at a health provider in Maryland. After two successful diagnostic and evaluative meetings with doctors, his transplant was set up at Mount Sinai, NYC. By November 2019, he was at home recovering after a successful liver transplant.

See more published case information here about: orthopaedic surgery, professional sports injury, sports injury, cancer treatment, or beating the odds.

Top 10 Reasons for International Health Coverage

Our health is everything. Whether we are talking about an individual, a family or a large corporation, optimal health enables us to function at our best. International health coverage provides an unmatched level of medical care. Here are the top 10 reasons to consider it:

- Avoid long and unreasonable wait times. In Canada, it is not uncommon for people to wait up to over 1 year to see a specialist or begin treatment.

- Do not be confined to healthcare within your country’s borders. Sometimes the best medical care for your specific condition is located outside your country. International health coverage enables you to acquire that care regardless of where you live.

- Gain access to the best medical professionals and institutions worldwide. From doctors to specialists, to surgeons, to medical facilities, international health insurance crosses borders and solidifies appointments wherever necessary, quickly and expediently.

- Funding. Know that you will not be worrying about money at a time when you should focus on your health.

- Get an optional comprehensive health assessment every year. Receive screenings, careful evaluation of your risk factors and a customized plan to help you achieve optimal health. Many people report that these types of assessments changed their lives.

- Obtain an optional second medical opinion. Hear what another top specialist in their respective field has to say about your condition, so you can make informed health decisions.

- Receive discounted medical services in the US. Through our partnership with UNH, our International Health Coverage can provide you with significant discounts on expensive, yet necessary, medical care.

- Get coverage for pre-existing medical conditions after 24 months for Group plans. Best Doctors Insurance is one of the few international health insurance companies that cover any pre-existing medical condition after 24 months.

- Invest in your employees. Employers who give their employees the care they deserve can create and sustain a corporate culture of engagement, retention and loyalty.

- Benefit from peace of mind. With an international policy in place, you can rest assured that you and your family's health is in the best possible.

For more information about Best Doctors Global Medical Care Insurance:

Get a quote by filling in the quote request form at the top of this page, view pricing and policy wording information. If you have any further questions, please call toll-free for assistance at 1-888-888-0510 in North America; 1-604-259-2544, 1-403-800-1582; or 1-647-799-203 (outside North America).